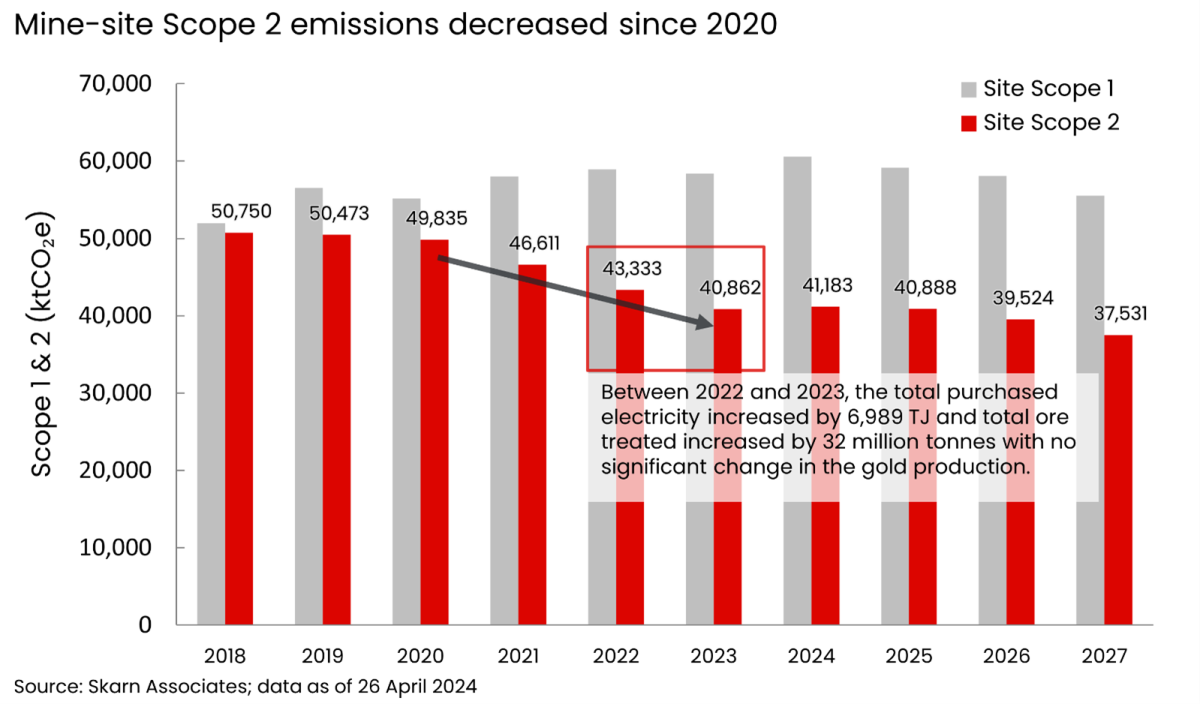

In 2023 global gold production emitted a total 50.5 MtCO2e, of which 30.3 MtCO2e and 20.2 MtCO2e came from Scope 1 and Scope 2 emissions respectively. This represented an increase in the intensity of gold production by 1.5% year-on-year.

Recent Skarn data reveals a significant reduction in the Scope 2 emissions allocated to gold production, which fell by 568 kt CO2e. This despite a slight increase in gold production of 351 koz. Scope 1 emissions allocated to gold actually rose in 2023, though this was more a function of a change in the price of copper and gold resulting in a larger weighting of emissions towards gold where these metals are found as co-products; looking at total site Scope 1 emissions for properties that produce gold in some quantity, direct emissions fell by nearly half a million tonnes CO2e.

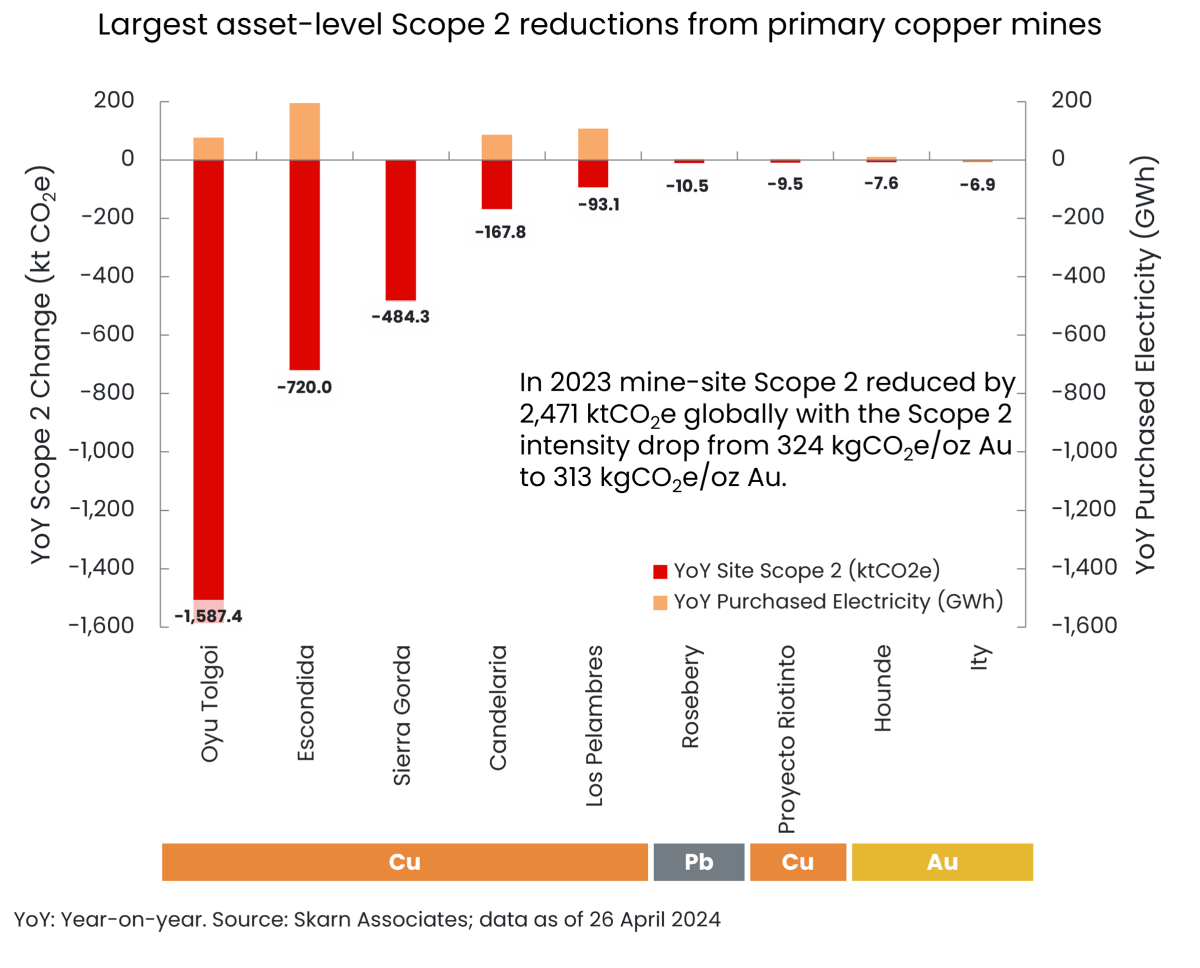

The reduction in Scope 2 emissions came largely from the copper mining sector where gold is produced as a co-product. During this period, there were major asset-level Scope 2 reductions through renewable power purchase agreements.

In 2024, Skarn expects that production volumes will rise for both copper and gold in our dataset of properties. As such, total CO2e emissions are set to increase – Scope 1 will rise in line with increased diesel use globally alongside mining activity, while Scope 2 will remain relatively flat. However, the carbon impact of indirect energy purchases from the copper mining sector will continue to fall, while increased energy use will lead to higher emissions among primary gold mines. This further reinforces the trend we have identified that decarbonisation of power purchases at copper mines is the current primary driver of decarbonisation of gold production. Primary copper E0 (Scope 1 and 2) intensity is expected to fall by 8%, to 700 kgCO2e/oz Au produced as a co-product, while primary gold E0 is forecast to rise by 7%, to 856 kgCO2e/oz.

There are key assets, especially copper mines producing gold as a co-product, that contributed to the total Scope 2 emission reduction while maintaining constant levels of purchased electricity. The most significant reduction was achieved through the purchase of International Renewable Energy Certificates (I-RECs) to decarbonise the electricity supply at Oyu Tolgoi copper mine in Mongolia. Mine-site Scope 2 fell by 1,587 kt CO2e from 2022 to 2023 while purchased electricity grew by 76 GWh. Additionally, the decarbonisation of purchased electricity supply by Chilean copper assets contributed to a total Scope 2 reduction of 1,465 kt CO2e from 2022 to 2023. These assets include Escondida, Sierra Gorda, Candelaria and Los Pelambres.

Among primary gold assets, 94 gold assets reduced site Scope 2 emissions by a total of 1,435 kt CO2e between 2022 and 2023. This was primarily due to decreased electricity consumption and lower grid emissions factors. The key assets were Hounde and Ity.

Endeavour Mining’s Hounde in Burkina Faso lowered Scope 2 emissions by 7.6 kt CO2e due to an increase in solar-powered electricity and a lower grid emission factor for purchased energy in Burkina Faso. Endeavour Mining’s Ity also reduced its mine-site Scope 2 by 6.9 kt CO2e, resulting from the increase in renewable energy supplied through the grid, from 23% to 30% of a total purchased electricity.

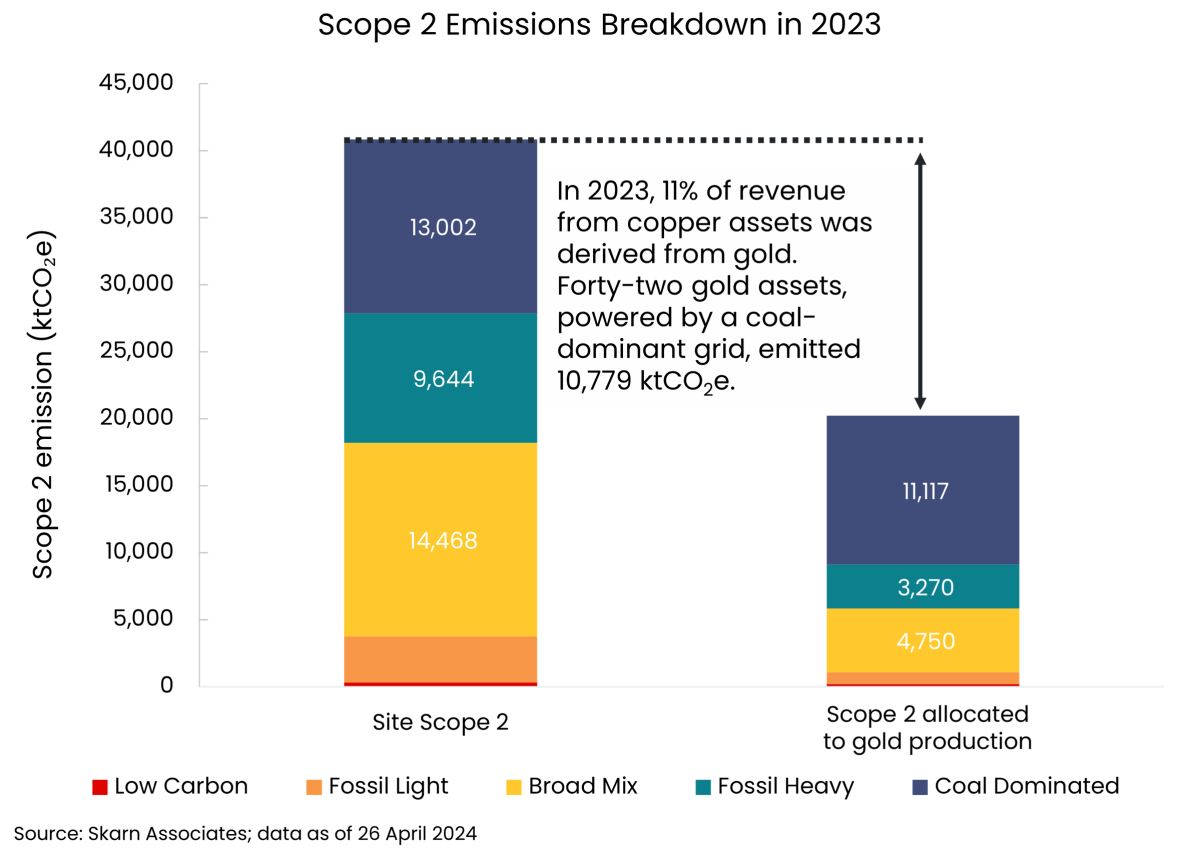

The grid emissions factors supplying gold assets show overall improvement year-on-year. Nevertheless, there are still 42 primary gold mines powered by a coal-dominant grid in 2023. Coal-heavy electricity grids accounted for 11,117 ktCO2e, or 55% of global Scope 2 emissions. Perhaps unsurprisingly, within this group falls South Africa, where mine-site Scope 2 emissions allocated to gold production totalled 8,712 ktCO2e, or 43% of global gold emissions associated with electricity purchases. More significantly, this is 17% of all emissions associated with gold production, despite South Africa only producing 4% of global gold output in our emissions database - a significant and clear emissions hotspot for the industry. The average emissions intensity for South African gold production was 3,249 kgCO2e/oz Au – four times the industry average in 2023.

→ Author: Akinori Suganuma for Skarn Associates Bulletin #44

MORE FROM SKARN

About Us

Skarn Associates is the market leader in quantifying and benchmarking asset-level greenhouse gas emissions, energy intensity, and water use across the mining sector.